As a value investor you can use options to buy your stocks at a lower price, reduce your cost basis and generate additional income. This article explains how you can take advantage of this unique option strategy.

As you may have noticed, this article is written by Paul Marcel from Celtinvest instead of myself, because what you are looking at is the very fist guest post ever on this website :-) Paul is a highly knowledgeable options trader and I proofread his article to make sure my readers would be able to get the most out of his valuable info. Hope you enjoy the article as much as we did writing it!

To make sure as many readers as possible will be able to understand the strategy explained in this article, a short introduction into options is included. If you are already familiar with options then you can skip this intro and start reading from the Selling Puts heading.

What is an option?

An option is a standardized contract which gives you the right to buy or sell an underlying financial instrument. In our case, this underlying financial instrument is a stock or exchange traded fund (ETF). Every option gives you the right to buy or sell 100 shares, so two options give you the right to buy or sell 200 shares. Simple. This option contract is valid until a predefined expiration date, after which your right to buy or sell expires.The price at which shares can be bought or sold is also defined by the contract, and is known as the strike price.

There are two types of options: call options and put options. You can buy or sell either type. If you buy an option you are the holder of the contract and if you sell an option you are the writer of the contract. If this sounds confusing, try looking at it like this: imagine person A takes a pen and writes down the rules of the contract. He is the writer and can now sell his contract to person B. After buying the contract, person B now holds the contract in his possession. He is the holder and can now decide whether or not to exercise the rights granted to him by the contract.

The buyer of a call option has the right - but not the obligation - to buy the underlying shares at the strike price on or before the expiration date. The seller of a call has the obligation to sell the shares, if asked.

The buyer of a put has the right - but not the obligation - to sell the underlying shares at the strike price on or before the expiration date. The seller of a put has the obligation to buy the shares, if asked.

|

Holder |

Writer |

|

|

Call Option |

Right to buy |

Obligation to sell |

|

Put Option |

Right to sell |

|

If you are new to options or if you just want to refresh your memory with some clear examples of how this buying and selling of options works in practice, then be sure to check out this short, but highly informative video.

What does an option cost?

In exchange for the right to buy (call) or sell (put) a stock or an ETF, on or before the expiration date, the purchaser of an option pays some money, which is called the option premium. The price of the contract is known as the debit, and it is the buyer's maximum risk. Why? Because in the worst case scenario the value of the buyer's option goes to zero, in which case he will have lost the premium he paid, but not a cent more (that is, besides transaction costs of course).

On the other side of the trade, the seller of the option receives the premium as a credit to his/her brokerage account. So the premium is a cost for the buyer of an option, but a source of income for the seller of an option. This is because the seller has to be compensated for the risk he is taking by taking on the obligation to buy (in the case of a short put) or sell (in the case of a short call) the underlying shares if the buyer decides to exercise the option contract, meaning that the buyer decides to use his right to buy or sell at the strike price that was granted to him when he bought the option contract. So in the worst case scenario, the seller can lose more than the premium, because the seller can be forced to purchase or sell shares at a loss. Brokerage firms hold cash from the premium as a guarantee against short positions.

The strike price, or exercise price, of an option determines whether that contract is in the money (ITM), at the money (ATM) or out of the money (OTM). If the strike price of a call option is less than the current market price of the underlying stock, the call is said to be in the money because the holder of the call has the right to buy the stock at a price which is less than the price he would have to pay to buy the stock in the market. As well, if a put option has a strike price that is greater than the current market price of the underlying stock, it is also said to be in the money because the holder of this put has the right to sell the stock at a price which is greater than the price he would receive in the market. The converse of in the money is, not surprisingly, out of the money. If the strike price equals the current market price, the option is said to be at the money.

|

Call |

Put |

|

|

In the money (ITM) |

Strikeprice < Stockprice |

Strike price > Stock price |

|

At the money (ATM) |

Strike price = Stock price |

Strike price = Stock price |

|

Out of the money (OTM) |

Strike price > Stock price |

Strike price < Stock price |

Investopedia created some wonderful videos for those who would like some further explanation of the in-the-money and out-of-the-money concepts.

What are Intrinsic Value and Time Value?

The premium of an option has two components: Intrinsic Value and Time Value.

Option Premium = Intrinsic Value + Time Value

As a value investor you know the Intrinsic Value to be an estimate of the true value of an underlying company. However, when it comes to options, Intrinsic Value describes the amount the stock price is above the strike price (for calls), or below the strike price (for puts). Therefore the amount by which an option is in-the-money is also called the Intrinsic Value of an option contract. It is also the value of the contract at expiration, since the Time Value will be zero by the end of the contract.

Time Value is defined as the option premium minus the Intrinsic Value. It is the amount that you pay for the possibility that it will be worth more in the future. Therefore an at-the-money or out-of-the-money option has no Intrinsic Value but only a Time Value.

|

Calls |

Puts |

|

Intrinsic Value = Stock Price - Strike Price |

Intrinsic Value = Strike Price - Stock Price |

|

Time Value = Option Price - Intrinsic Value |

Time Value = Option Price - Intrinsic Value |

So the Intrinsic Value is only affected by moves in the underlying stock price.

Let's consider an example using Apple (AAPL). If AAPL were trading at $100 when you bought a 95 strike call option for $6.50, then $5 of the option's value would be Intrinsic Value ($100 - $95 = $5). The other $1.50 ($6.50 - $5.00) would be Time Value.

A 100 call purchased when AAPL is trading for $100 is at the money, which means it has no Intrinsic Value ($100 - $100 = 0), but only Time Value.

If the stock was trading at $100 when you bought a 110 call, the option is again all Time Value, since it has to rise $10 to be in the money.

|

Stock Price = $100 |

Strike Price |

||

|

95 call = $6.50 |

100 call = $3.50 |

105 call = $1.50 |

|

|

In-the-money |

At-the-money |

Out-of-the-money |

|

|

$5 Intrinsic |

$0 Intrinsic |

$0 Intrinsic |

|

|

$1.50 Time Value |

$3.50 Time Value |

$1.50 Time Value |

|

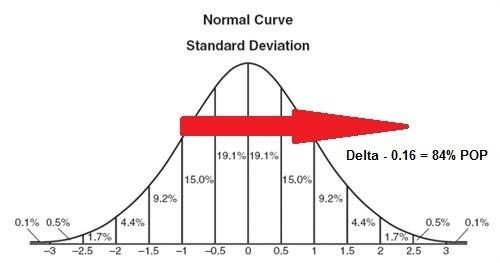

Time Value is subject to several factors, primarily time to expiration and implied volatility (IV). Implied volatility is the market's expectation of the future volatility of the underlying stock. It represents 1 Standard Deviation (SD) expected move in the stock for the next year, displayed as a percentage. As I am writing this article, the SP500 is trading at 2000 and has a 13% IV. This means 1 SD is +/- 260 points (2000 * 13% = 260).

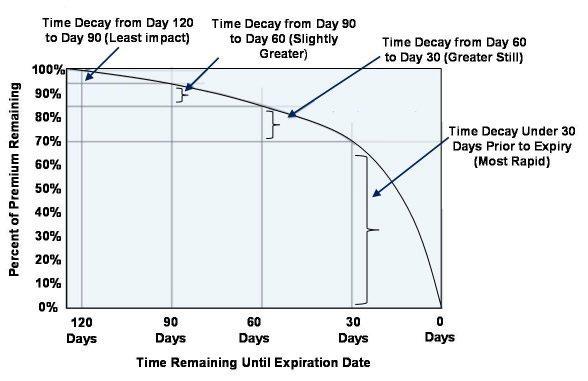

Implied Volatility is derived from the option price itself, and represents demand for the option. The higher the implied volatility, the higher the expectation that the underlying stock will make big moves, which in turn increases the option's chances of ending up in-the-money. And this increased chance of an option ending up in-the-money means that the option's premiums are higher, because the sellers want to be compensated for this extra risk they are taking. However, the Time Value decays as expiration nears and time decay increases dramatically in the last 30 days as expiration approaches.

Now that you have a basic understanding of how options work, it is time to see how you can use this knowledge to buy stocks for less than the market price, reduce your cost basis and generate extra income with very little risk involved.

Selling Puts

Want to be paid to buy stocks? Want to reduce your cost basis? Want to generate extra income?

Many stock investors use "limit orders" to get into long positions, which means these investors tell their broker to purchase a certain number of shares at a specified price or better. Another way to buy stocks for less than the current market price is an option strategy called selling cash-secured puts. Remember, if you sell puts, you have the obligation to buy the stocks at the strike price if the buyer of the option decides to exercise his right to sell. "Cash-secured" simply means that you have enough cash in your account to buy the stocks at the designated strike price if necessary. This is a neutral to bullish strategy which can be used to generate income, or to enter long stock positions at attractive prices.

How? Well, if the option buyer does not exercise, you get to keep the full premium as pure profit. If, on the other hand, the buyer does exercise, you have to buy the stocks at the strike price, but also get to keep the premium, which therefore lowers your cost basis! So you can sell puts if you think the stock is going to stay flat or go up slightly, but only if you are willing to buy the stock if assigned. Because if you are already willing to buy a certain stock, then selling puts is a win-win strategy: you either earn the premium, or you get to buy a stock you already wanted to own at a lower price! For this reason, selling puts can be an excellent way to initiate long stock positions, and get paid to do so.

Puts can be sold cash-secured or naked. As explained before, cash-secured means you have the cash in your account to purchase the stock at the strike price if assigned. Naked means you have a lower buffer, or margin, in your account. The return on capital is much greater for selling naked puts than selling cash-secured puts, but the use of leverage can be dangerous. In the case of value investing, I suggest to stick with a cash-secured put strategy.

So, you want to get paid for buying Apple shares?

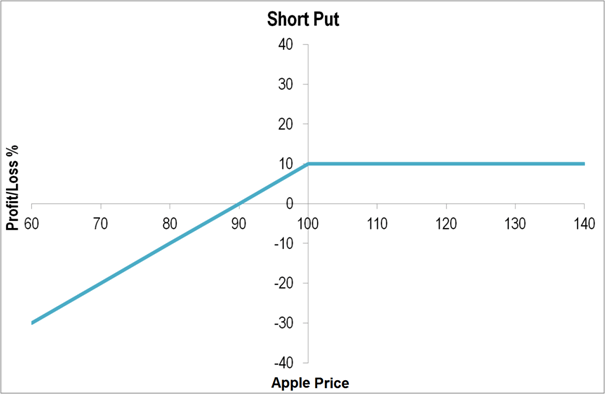

Here is an example of a payoff diagram for a Naked Put:

In this example, the writer sold the $100 strike put for $10/contract.

At expiration, three things can happen:

1) Apple closes above $100:

The writer keeps all the option premium and can now sell another put to keep reducing his cost basis and generate more income.

2) Apple closes between $90 and $100:

The writer can do two things:

a) He can close his option position between $0 and $10 and keep just a portion of the option premium.

b) He lets the put expire and keeps all the premium. But he will be assigned and has to buy 100 shares of Apple at $100 each. The effective purchase price of the stock is $90 ($100 purchase price - $10 premium) and he can now sell a call against his long stock (Covered Call*) to keep reducing his cost basis and generate more income.

3) Stock closes below $90:

The writer can do two things:

a) He can close his option position and take a loss.

b) He lets the put expire and keeps all the premium. But he will be assigned and has to buy 100 shares of Apple at $100 each. The effective purchased price of the stock is $90 ($100 price - $10 premium) and he can now sell a call against his long stock (Covered Call*) to keep reducing his cost basis and generate more income.

*Covered Calls might be explained in more detail in an upcoming article

How to choose which Put to sell

There are two factors to take into account when deciding which Put to sell: expiration date and strike price.

1) Expiration Date:

As we already saw in the Time Decay graph, the erosion of the premium of an option accelerates as expiration's deadline approaches. So of course, you can sell any Puts that fit your investment goal but if you really want to maximize your return it makes more sense to sell option with less than 60 days remaining.

You can check available options and their expiration dates in the option chain of your broker. Liquid stocks have weekly expiration dates. The shorter the time to expiration you choose, the more "aggressive" you are, because this means the stock has only very little time left to move in- or out-of-the-money.

2) Strike Price:

Use option Delta (δ) to choose the right strike price.

Delta definition:

Delta is a ratio that compares the change in the stock to the change in the option. For a put option, the delta is negative because as the stock increases, the value of the option will decrease. So a put option with a Delta of – 0.35 will decrease by 0.35 for every $1 the stock increases in price.

Reminder: As an option seller, you want to sell an option which only has a Time Decay Premium, and no Intrinsic Value. The put option should therefore always be either at-the-money or out-of-the-money.

This means that you should always sell an option with Delta > -0.50.

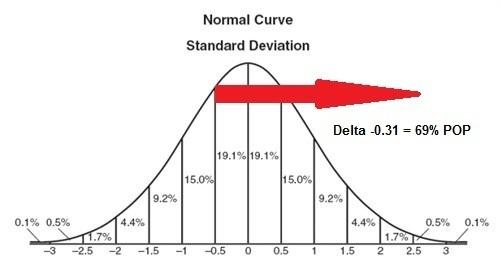

Depending of the premium you get for the selling of the option, I suggest that you sell between a -0.16 and a -0.31 option Delta.

A -0.16 Delta means your option is at one standard deviation out of the money and you have a 84% probability of profit (POP).

A -0.31 Delta means your option is at 1/2 standard deviation out of the money and you have a 69% probability of profit (POP).

So the higher the Delta you of the option you are selling, the more "aggressive" you are, since a higher Delta offers you a higher premium, but a slightly lower Probability of Profit (POP). If you want to enter a long position and therefore do not mind having to purchase the stocks, then a higher Delta is the way to go.

For those of you unfamiliar with Standard Deviation and Normal Curves, click here to check out a video by Investopedia on the subject.

Here is what an option chain and Delta look like:

How to trade options ?

Now that you know what options are, how selling puts can help you generate income and lower your cost basis, as well as how you can determine which put options to sell, you should check with your broker to see if you can sell options through them. If this is not possible, you could open an account at an online option broker like TradeStation, which has won several awards for best online broker when it comes to trading:

https://www.tradestation.com/why-tradestation/awards

If you

Disclosure

The information in this presentation including all strategies discussed, is strictly for illustrative and educational purposes only and is not to be construed as an endorsement, recommendation or solicitation to buy or sell securities.

Did you like this article? Share your feedback in the comments section below!