Even though I've only written one (big) blog post this month, much has happened behind the scenes. October was also a turbulent month for my portfolio, but in a good way! You can read all about it in this edition of my Monthly Money Report!

MAJOR HAPPENINGS THIS MONTH

MSN Moneycentral troubles - You might be or might not be aware that I have created a powerful stock analysis tool which allows you to analyze a company in seconds instead of hours. All you have to do is enter a ticker symbol! Sound good, huh?

Unfortunately there was a small hiccup this month, because one of my data sources, MSN Moneycentral, revamped their website and therefore broke my data connection. To be fair, they did a really good job with the redesign! I had to be a bit creative, but I immediately updated the premium Value Spreadsheet and now it uses Morningstar data instead. I also used this opportunity to add some extra features and improve some existing ones.

Podcast happenings - My collaboration project, The Money Tree Investing Podcast, is doing way better than expected! Not only were we featured in the iTunes New & Noteworthy section for about two full weeks, but we also rank #14 in investing podcasts, even though we've only been live for a couple of weeks. Sweet!

It was an absolute honor to interview Hewitt Heiserman, author of the highly original investment book It's Earnings That Count, on the topic of earnings manipulation and financial statement analysis. Hewitt is very knowledgeable, so we were able to explore the subject in detail. Very interesting conversation which I recommend you should check out. He also mentions a lot of valuable resources, like books and free presentations.

Weekly stock analysis vodcast - That's right, a vodcast. I decided to create a short 10 minute video each week on my YouTube channel in which I analyze one stock. This brilliant idea was not mine, I got the inspiration from one of my readers, so thanks for that! Of course you can also find these videos on the videos page of this website. Be sure to subscribe to my YouTube channel if you want to be the first to get notified the moment a new video is released.

Index EDGAR - As most of you probably know, all annual and quarterly reports from all publicly traded companies in the United States are filed in the SEC.gov EDGAR database. Unfortunately, it is hard to find a less user-friendly system on the internet than that particular database…

They do not use Ticker symbols like every single financial website, but CIK numbers which no one else is using. They do not list which fiscal quarter the reports cover, only the filing date. To make their URL structure even more confusing, each filing gets assigned a random Accession Number. And even if you manage to find the file you want, it is not presented to you in a human-readable way.

Then I read that an angry SEC employee, with no experience in web development, quit her job to build the website rankandfiled.com, just to show her ex-employer how simple it is to make the website ten times more valuable for investors. I do have experience in web development, and therefore I started a project which I call Index EDGAR, or iEDGAR for extra coolness points.

The initial challenge is to make it easy to find the file you are looking for. If you currently want to get the third quarter results of Johnson & Johnson (JNJ) from the SEC website, you have to go to:

http://www.sec.gov/Archives/edgar/data/200406/000020040614000089/0000200406-14-000089-index.htm

Logical? Not really. Instead I want to create URLs like:

/stocks/JNJ/2014/Q3

More logical? I think so. But even though this might help some investors out, this is only phase one of a much more elaborate scheme. After I have indexed all these files, I want to process the SEC's raw XBRL data files to generate standardized financial statements which I can then use as a reliable data source for my premium Value Spreadsheet.

This way I will prevent future incidents like the one I had this month with MSN Moneycentral, and it will give investors like yourself easy access to a professional data feed, which is now unaffordable and which is one of the main benefits XBRL promises.

This is not going to be a simple task, because there is hardly any information available on how to actually process and build an application around XBRL documents, but I'm sure I'll be able to figure it out.

Apologies for the rambling, but it's a massive project and I'm excited to share the news with you!

*Actually, between the time of writing and publishing of this article, I actually managed to index 127.568 XBRL files from the SEC server! Now I have to match CIK to ticker symbols and build an interface. Should be online somewhere next week. Exciting!

PORTFOLIO NEWS

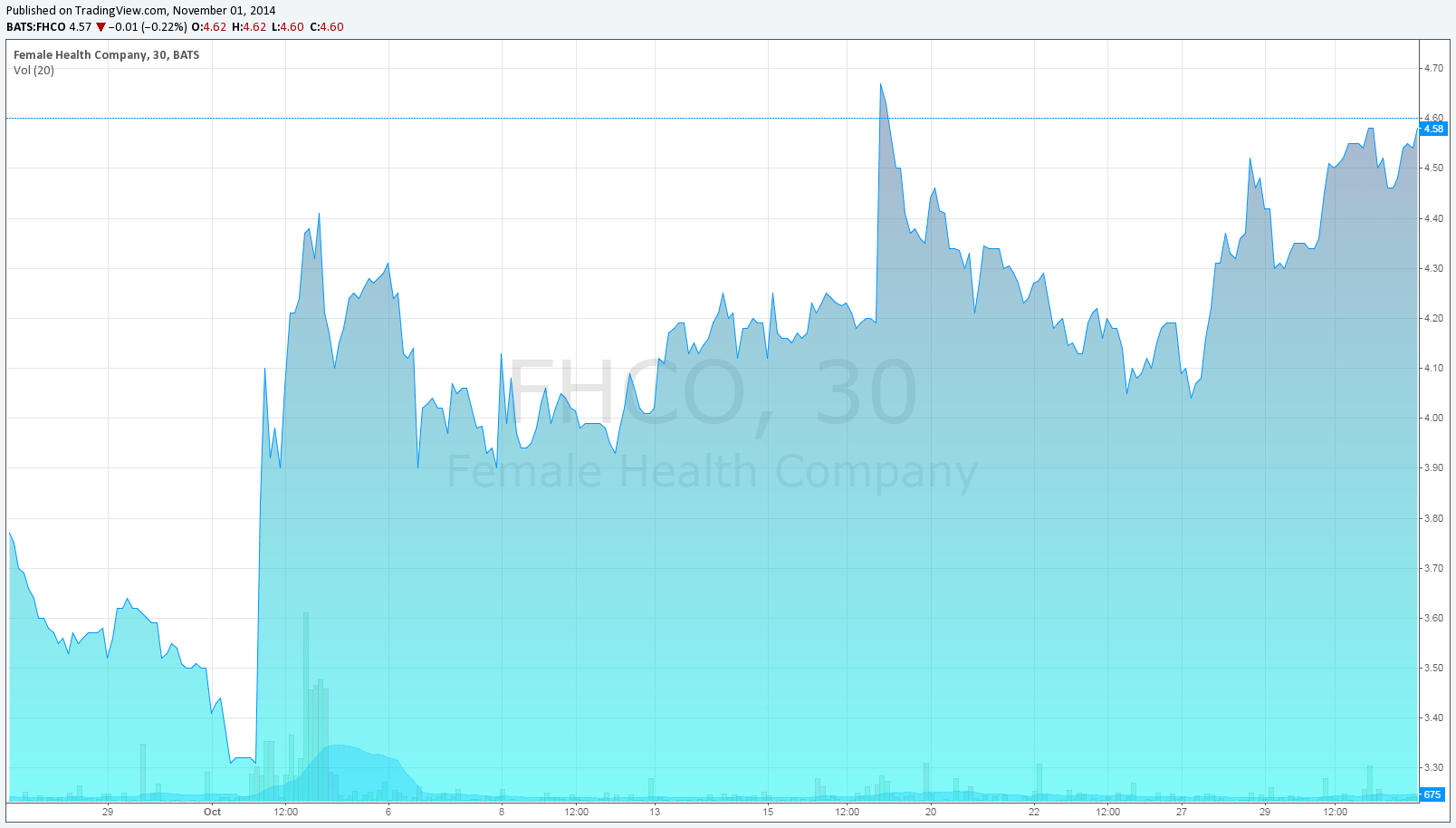

Wow, what a month! All my holdings went up significantly this month, as well as Omega Flex (OFLX), a company I pitched in my September Money Report, which went up 20% in one month. My largest holding, Female Health Company (FHCO), rose no less than 34% in one day on news of a massive order from the Brazilian government. Apple (AAPL) hit a new all-time high after a decent earnings report. And even my black sheep EZCorp (EZPW), which is currently going through a massive restructuring period, did alright.

While it is always nice to talk about your stocks when they are going up, I do realize that the market as a whole is definitely not cheap from a value perspective. Still, if you look hard enough there are some bargains to be found, but I would caution you not to go all-in at this time, but rather wait for a serious correction. It's worth the opportunity costs.

LESSONS LEARNED

What is good and what is evil? - In previous reports I discussed my fascination with the Stoic philosophy of the ancient Greeks. Epictetus says that only things within our control, actions or urges we can consciously control, can be good or evil. If your stocks drop in price, this is outside of your control. The event itself is not good, nor evil. Only the way you decide to react to it is.

Currently I'm reading Shantaram, which came highly recommended and which I already want to place in my top 3 favorite books ever! In this breathtaking page-turner, a Maffia boss/philosopher, with the beautiful name of Lord Abdel Khader Khan, explains his theory about the universe and his definition of good and evil. It's a thought provoking explanation which I wanted to share with you so you can draw your own conclusions from it. This is how the main character, Lin, summarizes the theory on page 705:

"The universe began about fifteen billion years ago, in almost absolute simplicity, and it’s been getting more and more complex ever since. This movement from the simple to the complex is built into the web and weave of the universe, and physicists call it the tendency toward complexity.

We’re the products of this complexification, and so are the birds, and the bees, and the trees, and the stars, and even the galaxies of stars … the final or ultimate complexity – the place where all this complexity is going – is what, or who, we might call God. And anything that promotes, enhances, or accelerates this movement toward God is good. Anything that inhibits, impedes, or prevents it is evil.

And if we want to know if something is good or evil… then we ask the questions: What if everyone did this thing? Would that help us, in this bit of the universe, to get there, or would it hold us back? And then we have a pretty good idea whether it’s good or evil."

FUTURE PLANS

In the upcoming month I plan to write a summary of my favorite investment book, Buffettology, which I've mentioned numerous times already. Also, much of my time will be devoted to the iEDGAR project so I can hopefully get a minimum viable product online by the time my November Money Report hits the press.

Another side-project I'm involved in is building a Virtual Reality camera to shoot content for the Oculus Rift. You know, that little company Facebook took over for $2 billion. I'm also interviewing an XBRL expert for next week's podcast episode, so that will be an interesting conversation, especially for myself! :-p Other than that, I will definitely hold a live webinar for you guys, probably in the third week of November.

That's it for now, thanks for reading!

What do you think: Am I wasting my time with this iEDGAR project of mine or do you see some potential?