Welcome! This is the first in a series of reports I'm writing at the end of every month about the progress I'm making with my investments and businesses. I talk about things that impacted my portfolio, newsworthy events regarding my businesses, and the lessons I learned during that month. Every report ends with an announcement of my plans for the upcoming weeks. I will be as open as possible with you.

I got the idea of writing these monthly reports from two major sources of inspiration for me, Chris Ducker and Pat Flynn. These guys are awesome! These reports will help me to keep a log of my progress as I grow my business and my portfolio. It's like a diary. It is also a way for me to share some more personal stories with you instead of just high level blog posts. I hope you enjoy this fly on the wall experience!

Without further ado, let's dive in!

MAJOR HAPPENINGS THIS MONTH

The month June, as well as the month May actually, was all about my video course, Value Investing Bootcamp.

Launching my first ever online course was a crazy ride and a LOT more work than I had expected, especially because I wanted to make it the best course on value investing available today. Setting the bar high keeps me motivated.

However, I'm very pleased with the result and over 900 investors have already signed up!

Interview with Andrew Sather- Out of the blue I got a private message on Twitter from Andrew Sather, who runs the fantastic eInvesting For Beginners website. He said he stumbled upon my content, liked what he saw, and wanted to do an interview with me. I must admit that I was very excited about this, because this was going to be the first time anybody has interviewed me (besides job interviews and failed dates).

Due to some technical issues on my side the sound quality is appalling, but we did cover a lot of interesting content, especially for beginners. For example, we talked about why people generally struggle financially all their lives, how to avoid financially troubled companies, and how I use stock screeners to pick stocks. Click here to watch the full interview.

Value Investing Bootcamp Podcast- Inspired by an article written by Chris Ducker, who I mentioned before, I decided to create a 20 episode "nano podcast" as part of the launch of the video course. What I liked about this idea was that I would be able to reach a new audience, podcast listeners, who I might otherwise never reach via my blog alone. Also, it is a great way to give some truly valuable content away for free.

Again, it was MUCH more work and way more technical than I had anticipated to actually produce a podcast. This time an amazing podcast guide by Pat Flynn helped me to set things up correctly. At the time of writing, the 19th episode just went live.

Shortly after I launched this podcast, other things started happening. For example, at the end of the interview with Andrew, he asked me if I was interested in joining forces with him, Miranda Marquit from the Planting Money Seeds website, and 2 other financial bloggers to create an ongoing podcast series filled with interviews and valuable information for investors. More on this exciting development later.

Investment Breakthroughs Webinar- June was a month of firsts. First online course, first podcast, first interview, and also my first ever totally solo webinar. I've done two webinars before, but this time I personally managed it from start to finish. The reason this took so long is because webinar software is EXPENSIVE! However, I recently found out about Webinar Jam, which is affordable and integrates smoothly with Google Hangouts, so I figured I had no more excuses.

The amazing thing about webinars is the live, personal interaction with you guys. I love it! I told the story of how I lost half my savings when I just started investing, how I got to where I am today, and the lessons I learned along the way. You can watch the entire webinar recording here:

Invited to a Dutch value investing club- As most of you know, I live in Amsterdam, The Netherlands. While I absolutely love Amsterdam, it is sometimes a shame that I am unable to talk with you guys in person and discuss investing due to the massive distances. However, a loyal reader of my blog, who also runs his own (Dutch) investment blog, invited me to join a select investment club. I attended the first meeting last week and it was an absolute thrill to talk to like-minded, extremely intelligent people about investing and their strategies!

PORTFOLIO NEWS

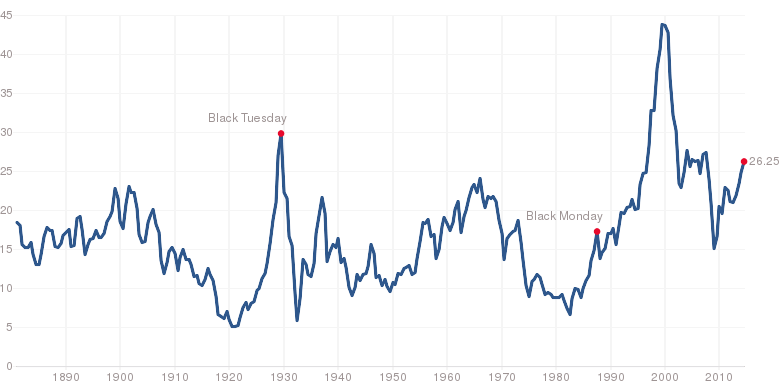

Warren Buffett and other great value investors often say you should largely ignore the broader market and macro-economic factors. However, everyone in the investment club seemed to agree on the fact that it is currently very challenging to find true bargains. Also, if you look at the Shiller P/E ratio, which takes the price to average earnings from the past ten years, of the S&P500 is nearing the pre-crisis high of around 27.

This indicates that stocks in general are not very cheap at the moment. Because it is so hard to find true bargains at the moment, I'm currently 60% in cash. Still, if you look hard enough, you might be able to identify a hidden gem here and there. For example, I've had The Female Health Company (FHCO) on my radar for a while. Amazingly profitable, no debt, healthy dividend yield, unique product, near monopoly, underfollowed small-cap. A wonderful company, but it was just a bit too expensive.

However, FHCO has very volatile earnings since they have only a small number of very large clients, governments. So if one client decides to postpone his order for a couple of months, the quarterly earnings might disappoint this time, but will be extra high the next quarter. Such a disappointing quarterly earnings release has resulted in an almost 50% price drop, which is why I have been happily adding it to my portfolio on its way down.

In a recent press release, announcing additional buybacks, the company said: "Management believes the Company's common stock is currently undervalued in the market and that the current share price does not reflect the Company's intrinsic value or its prospects for long-term growth in revenue and earnings."

Apple (AAPL), which I have in my portfolio for a couple of months already, is finally picking up some pace, and I believe it still has at least 20-30% to go. Their 7:1 stock split might act as a catalyst, since it takes away the psychological $700 price barrier the company was struggling with. Also, I believe Tim Cook simply needed some time to steer its massive company in the direction he wants it to go, and this year, but especially next year, we will find out if his actions paid off.

I generally dislike discussing individual stocks on the blog, because I truly believe you as an investor should not be influenced by my opinions on certain companies, but maybe I'm just a bit paranoid in this respect. Most of the times I will probably just discuss more general happenings in the market in this section of the report. Oh well, we'll see how it goes.

LESSONS LEARNED

June was a hectic, busy, but satisfying month in which I (re-)learned some valuable lessons, namely:

The harder you work, the luckier you get- I don't think there has been a month in my life in which I have worked harder than this particular month, except maybe during my internship at IBM, but I've got so much in return. Working hard and creating true value for others creates a ripple effect, and the result is that great things start to happen all around you. The invitation to the interview, investment club, and podcast team are amazing examples of this.

Industry & frugality are the key to financial success- This month I finished reading The Autobiography of Benjamin Franklin. In this inspiring, but difficult to read book, Franklin describes his pursuit of several virtues, but mentions that in order to be relaxed enough to be truly virtuous, you must first have your finances in order. He promotes industry & frugality as the means to achieve this. While I'm already applying these principles, they are definitely important to keep in mind.

Always question conventional wisdom- One of my favorite investors, John Templeton, said that "if you want to have a better performance than the crowd, you must do things differently from the crowd." This idea was further reinforced when I listened to The Tim Ferriss Show, in which author Neil Strauss said that "Not accepting norms is the secret to really big success and to changing the world." Very true, very inspiring.

Be genuine and stay true to yourself- As this blog is growing, as well as my expenses, it is more important than ever to remind myself of the fact that your trust in me is what makes this whole thing tick. Therefore, I will be extra careful not to fall into the trap of taking your trust for granted and only trying to sell you stuff, like many big websites tend to do. That's not who I am and that's not who I want to be. Sure, I have to eat as well, but I will never, ever put your trust on the line for a quick buck. I will continue to create valuable, free content for you, like this massive blog post which took me hours to compose and my curated list of investing resources.

FUTURE PLANS

Wow, that was quite a lot of content, I hope you enjoyed it! This week I'll be contacting some big investment blogs to see if they are interested in promoting my value investing video course, and then I'll go on a two-week holiday to sunny Croatia to de-compress.

Also, I'll most likely produce the first few podcast episodes together with Andrew and the others. Stay tuned for this! Maybe I'll even throw in a webinar somewhere next month. Besides this, I also plan to launch a new chart on TradingView every week, not focused on techinical indicators or individual stocks, but instead I'll try to use the charts to explain certain concepts related to value investing in a more visually appealing way than just plain text.

One major thing that is going to change is that I will be creating exclusive content for my mailing list subscribers. This content will not be available on the blog. This is because I want to show my appreciation for the people who join the list. You are all awesome! Expect me to ask you for some inspiration on topics to write about :-) In addition, I plan to add some bonus content to the course after I'm back from my holiday. Guess I've got a lot of writing to do!

There is also something radical I am considering... Since I started the blog, over 4000 people have joined my mailing list. This is way more than I had ever dreamed of. Yet, I notice that there is a core of fans, and a bunch of people who don't even bother to open my emails (could also be they end up in their SPAM box of course). Now that I am planning to write exclusive content for my loyal followers, I'm thinking about deleting people who have not opened the last 5 emails I sent out, just this one time, so we'll have a core of enthusiasts left from which I can then build a closer relationship with more interaction. This would also make my statistics a whole lot more realistic. Or am I being too impulsive here?

NOW IT'S YOUR TURN!

I'd like you to tell me what you have been up to the past few weeks, how your portfolio is doing, and what you've got planned for the coming month! I'm curious, so write a little comment and I will personally answer every single one of you.

Until next month…

.png)