To forecast the value of Tesla stock might seems out of place on this website dedicated to value investing, but I've had so many people ask me about my views on Tesla (TSLA), and I have had several heated discussions with my uncles and my dad, who all believe that Tesla does not stand a chance against the big, established car companies (they're wrong!), that I felt compelled to write this article.

In this article, I explain why I, as a hardcore value investor, invested a large part of my portfolio in Tesla stock, and why I believe the company will be worth TRILLIONS by 2030.

But first, let me briefly tell you how I accidentally ended up owning Tesla shares...

My story

In August of 2015 I purchased shares in SolarCity, then still managed by Elon Musk's cousins, Peter and Lyndon Rive.

Their unique offering was to allow clients to rent solar panels so they could start making money from day 1, instead of having to splurge a couple of thousand dollars and only seeing any real returns after several years.

After running the numbers, it seemed like a great value stock, and so I invested.

Just one year later it was announced that Tesla and SolarCity would combine, in a rather controversial deal.

This transformed my SolarCity shares into Tesla shares, and I wasn't super happy about that back then...

Still, I kept the shares in my portfolio and watched them hover around the $300 mark for years.

Nothing spectacular happened.

Then, the #1 investor in the private investment club I'm in started talking about his research into Tesla, and he made some very intriguing points.

According to his research, Tesla seemed to have an unassailable talent and technology lead, and the stock should be worth a lot more than $300.

I listened closely, but did not act on it.

Then, at the end of 2019, the audacious Tesla Cybertruck was unveiled and pre-ordered en masse.

I searched YouTube for some footage of the unveiling, and stumbled upon a video from Solving the Money Problem, and was taken by the guy's knowledge about Tesla and investing.

Since then, I watched every single one of his videos, which taken together paint a very clear and nearly inevitable path to extreme profitability for Tesla in the coming decade.

On top of that, I started reading the in-depth research done by ARK Invest, who are long term investors in disruptive innovation, and whose largest holding is Tesla stock.

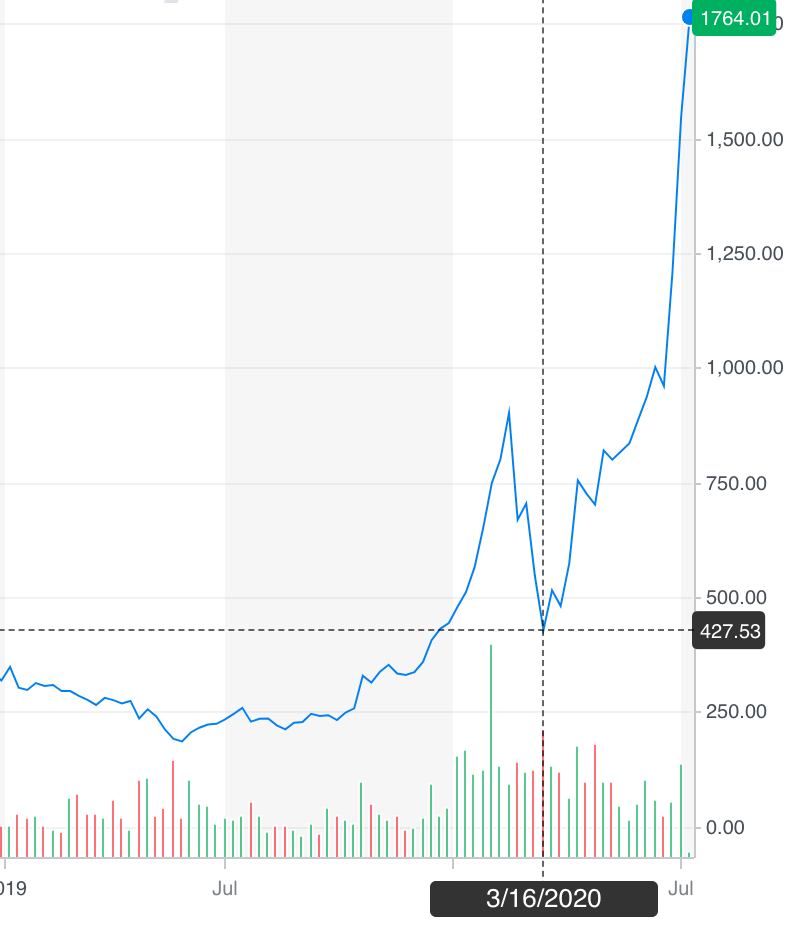

All of this information led me to purchase more TSLA shares during the COVID downturn in March, even though I normally only buy stocks from companies that have shown years of above average profitability.

So why did I make this exception?

Why did I stray from my otherwise ultra-logical investment strategy?

Had I gone mad?

No.

I honestly feel Tesla is an incredible company with huge competitive advantages, and will be worth several Trillion dollars within a decade.

But before we can peer into the future, we have to establish where Tesla as a company is today.

Tesla today

Today, in 2020, Tesla has achieved all of the milestones it set in its 2006 Master Plan:

- Build sports car (Tesla Roadster)

- Use that money to build an affordable car (Tesla Model S)

- Use that money to build an even more affordable car (Tesla Model 3)

- While doing above, also provide zero emission electric power generation options (Solar Roof)

They are also well on their way to achieve their goals set in Elon Musk's Master Plan, Part Deux:

- Create stunning solar roofs with seamlessly integrated battery storage

- Expand the electric vehicle product line to address all major forms of terrestrial transport

- Develop a self-driving capability that is 10X safer than manual via massive fleet learning

- Enable your car to make money for you when you aren't using it

Let's dive a bit deeper into these.

Tesla Energy

It is worth noting that the first item on Musk's latest Master Plan is not about cars.

It is about solar roofs and battery storage.

When you hear people say things like "Tesla is valued much higher than other car companies", is because Tesla is not just a car company.

A lot of their focus is in fact on energy products, which Elon Musk expects will be worth as much, if not more, than their entire car division at some point.

Tesla is currently producing about 1000 solar roofs per week in their GigaFactory.

Giga New York built 4MW of Solar Roof last week, enough for up to 1000 homes!

— Tesla (@Tesla) March 15, 2020

40% of the people who purchase a solar roof, also purchase at least 1 Powerwall, which further increases Customer Lifetime Value.

They've also been granted an electrical utility license in the UK, and have successfully implemented their grid-scale Megapack battery storage solution in several huge projects worldwide.

According to Musk:

At the site level, Megapack requires 40% less space and 10x fewer parts than current systems on the market. As a result, this high-density, modular system can be installed 10x faster than current systems.

All of this is managed by their revolutionary Autobidder software, which automatically optimizes energy storage and delivery, maximizing the revenues earned from Tesla battery solutions.

And these batteries, which are also used in their cars, are not just any batteries, they are the most efficient batteries in the world at the moment:

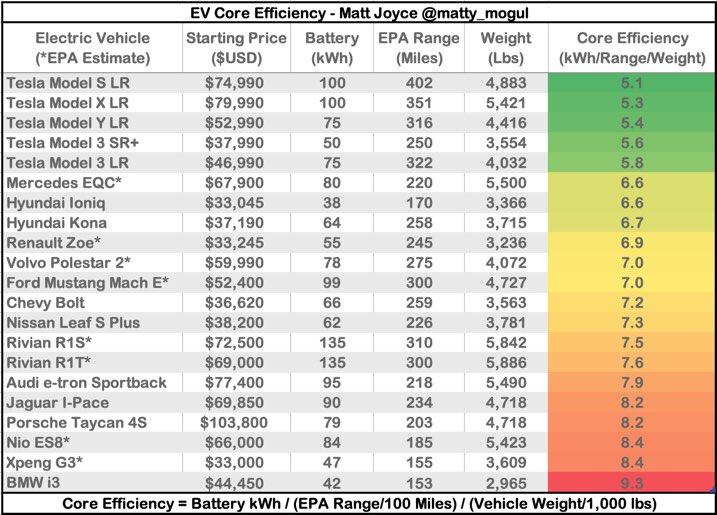

Notice those first 5 rows?

Tesla is dominating when it comes to battery tech, and there are more improvements coming now that they are building their own battery R&D labs and production lines.

Tesla Vehicles

In 2016, when the second Master Plan was written, Tesla had only launched the Model S sedan and Model X mid-size SUV.

They vowed to cover "all forms of terrestrial transport", leaving the terrestrial transport up to Musk's other highly successful company, SpaceX.

Since then, the more affordable Model 3, and recently also the Model Y crossover, have started rolling off the production line.

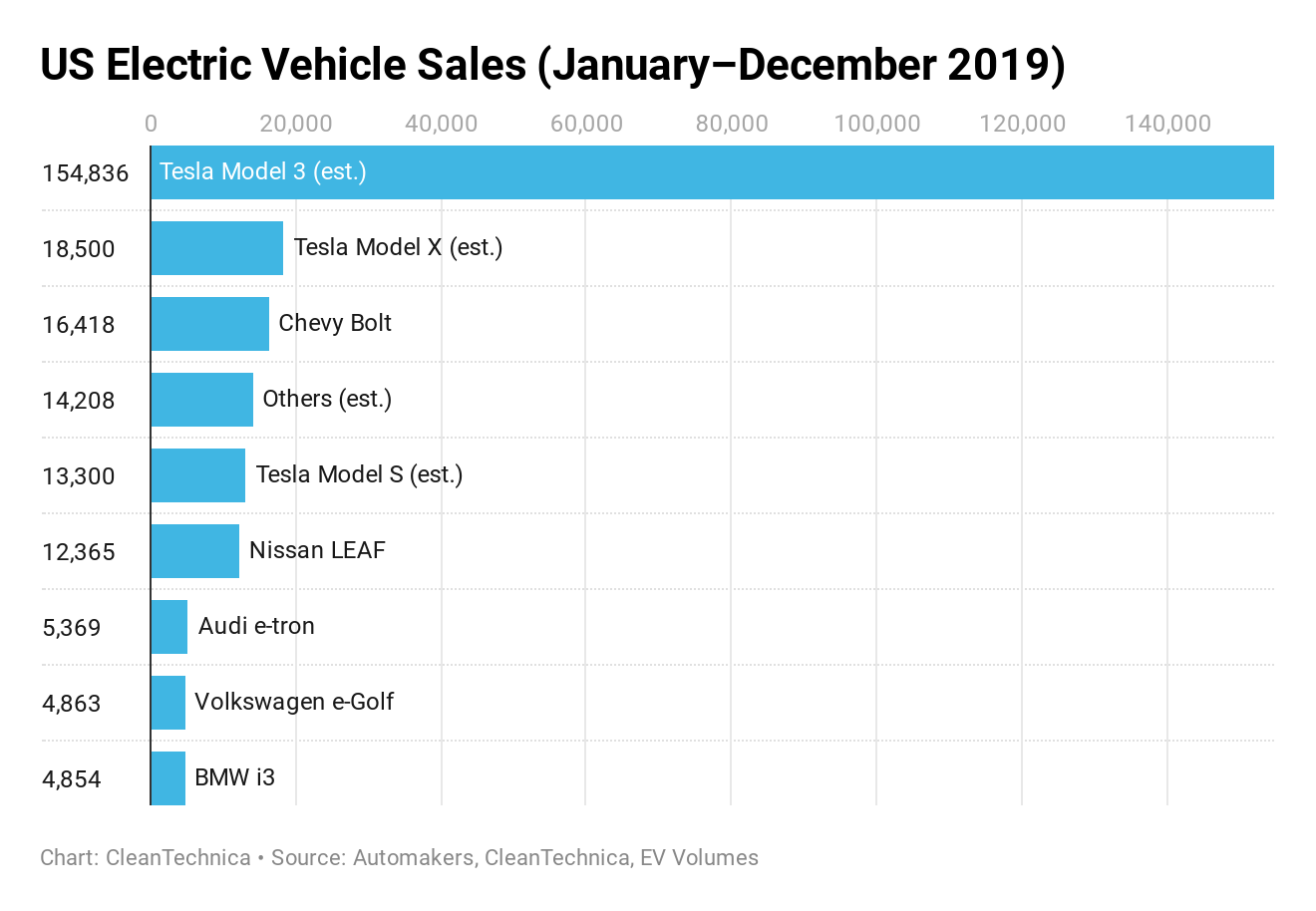

The Model 3 has been a smashing success.

It sold over 10 times more than the second most popular electric vehicle (which was the Model X...)

It won the Car of the Year award.

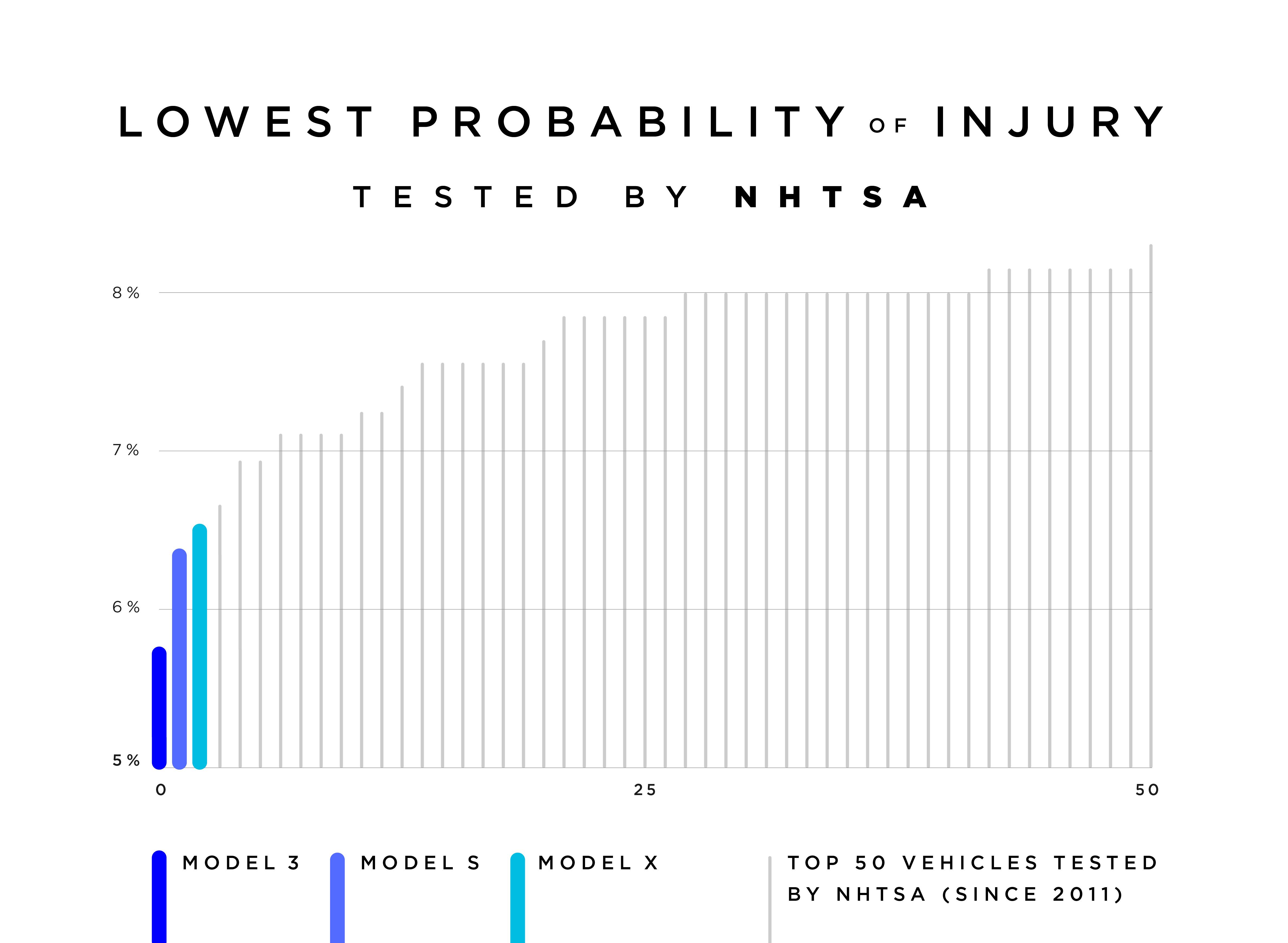

It was the safest car EVER TESTED (followed by the Model S and Model X...)

And Elon Musk expects demand for the Model Y to be more than that of the S, X, and 3... combined!!

And then there are of course the controversial Cybertruck, which received a couple hundred thousand pre-orders the day it was announced, as well as the Tesla Semi truck, and the new record-breaking Tesla Roadster, which all still have to enter production.

The rumor mill also hints at a potential Tesla van and compact car.

While at first glance this lineup looks pretty decent, the thing that is really impressive are the incredible efficiencies Tesla is able to achieve with each new iteration.

For example, the Model Y shares 75% of its parts with the Model 3, creating massive economies of scale.

The Cybertruck might look weird to many, but the reason for the stainless steel body is that it doesn't need a paint job, creating enormous savings in production time and costs.

Same for the right angles of the body; much easier to produce than smooth curves.

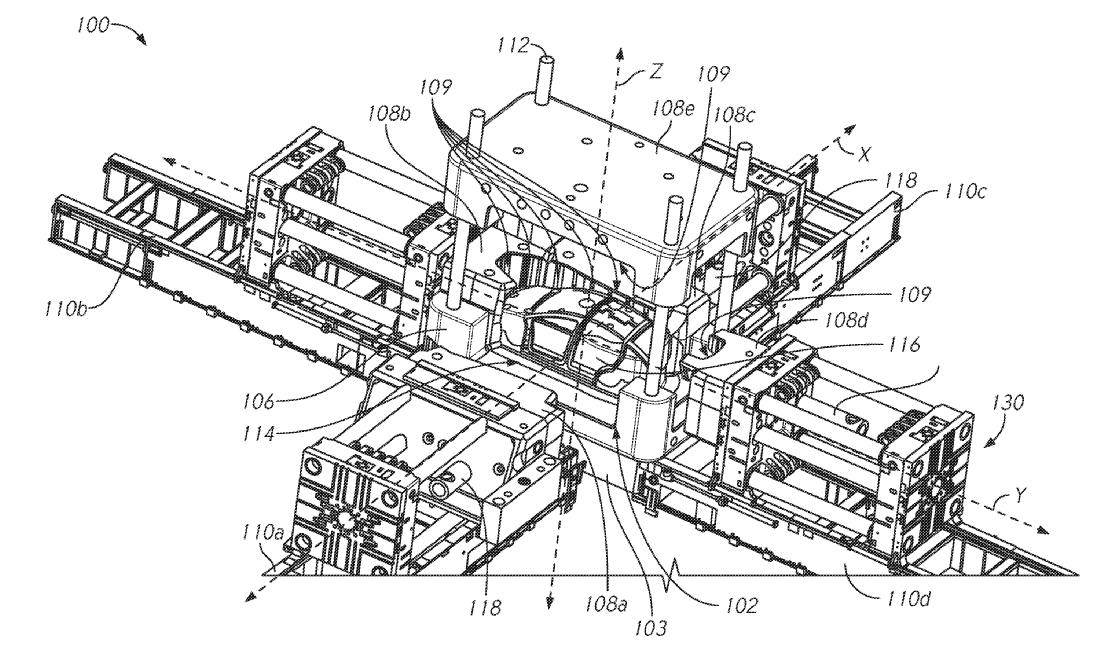

Then there is the gigantic die-casting machine Tesla patented in 2018, which today allows them to create a car body out of just 2 parts (eventually just 1), whereas the body of a traditional car consists of no less than 75 individual parts!!

This greatly reduces complexity and production costs.

So yes, Tesla makes cars, and they are being smart about it too, but their most important "product" might be "the machine that builds the machine": their Gigafactories.

While they were in "production hell" during the Model 3 production ramp a few years ago, their China Gigafactory was built and fully ramped within just a year after breaking ground.

And the best part: the China factory was 65% cheaper per unit of capacity, leading to much higher profit margins for cars coming from that factory.

Giga Berlin is following a similar path.

Today, Tesla is not able to produce enough cars to meet demand, but they will build Gigafactories as fast as they can make them the next few years to close this gap.

And the best part: other car companies are effectively funding these factories by purchasing billions of $ worth of ZEV credits from Tesla, just to meet emission standards and avoid massive fines.

Full Self-Driving

Autonomous vehicles, also referred to as full self-driving or level 5 autonomy, will revolutionize transport as we know it.

And it's a matter of when, not if.

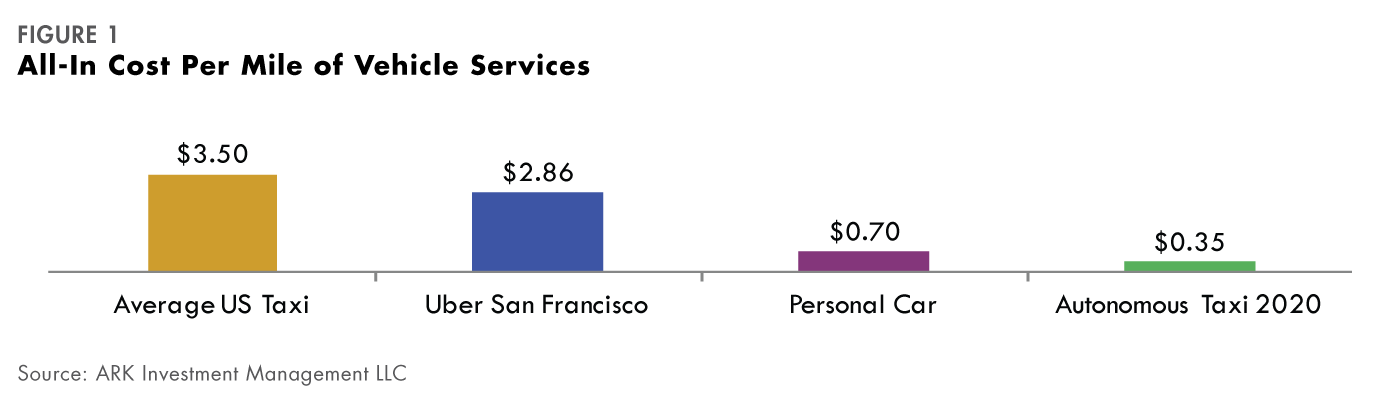

The promise is that once cars can drive themselves, a fleet of so-called robotaxis will become one of the main modes of transportation, because this will be much cheaper than either owning a car or taking a regular taxi with a human driver.

ARK Invest estimates that a robotaxi will cost around $0.35 per mile, compared to $0.70 per mile for owning a car yourself, thanks to higher utilization rates.

Instead of you driving your car only a few hours a day, your car could be used as a robotaxi while you weren't using it and earn you money while you sleep!

However, besides you being able to watch Netflix while your car drives you places, or your car earning you money, the main benefit of self-driving is that it is MUCH MUCH safer than having flawed humans drive.

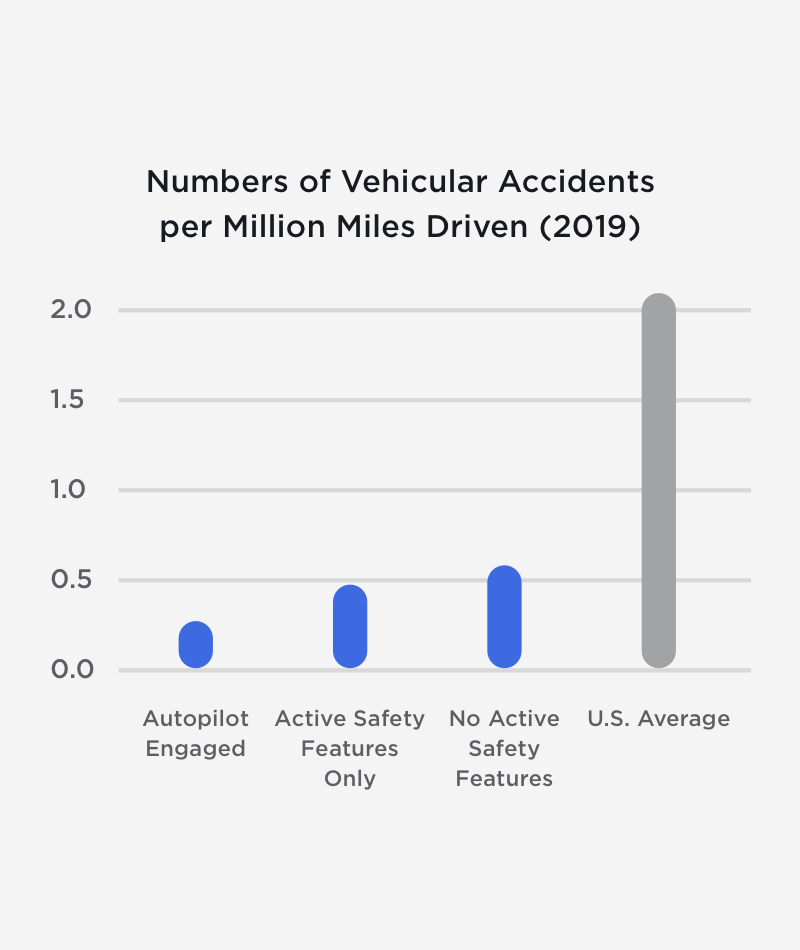

Today, Tesla cars that have Autopilot enabled are already about 10 times less likely to get into an accident than the US national average!

ARK expects car accidents to eventually decline by a whopping 80% as more cars on the road become autonomous.

This will save millions of lives!

But while this dream sounds amazing, we're not fully there.

Level 5 autonomy has not been completely solved yet, but Musk recently said they are close (he has been saying this for a while now, though).

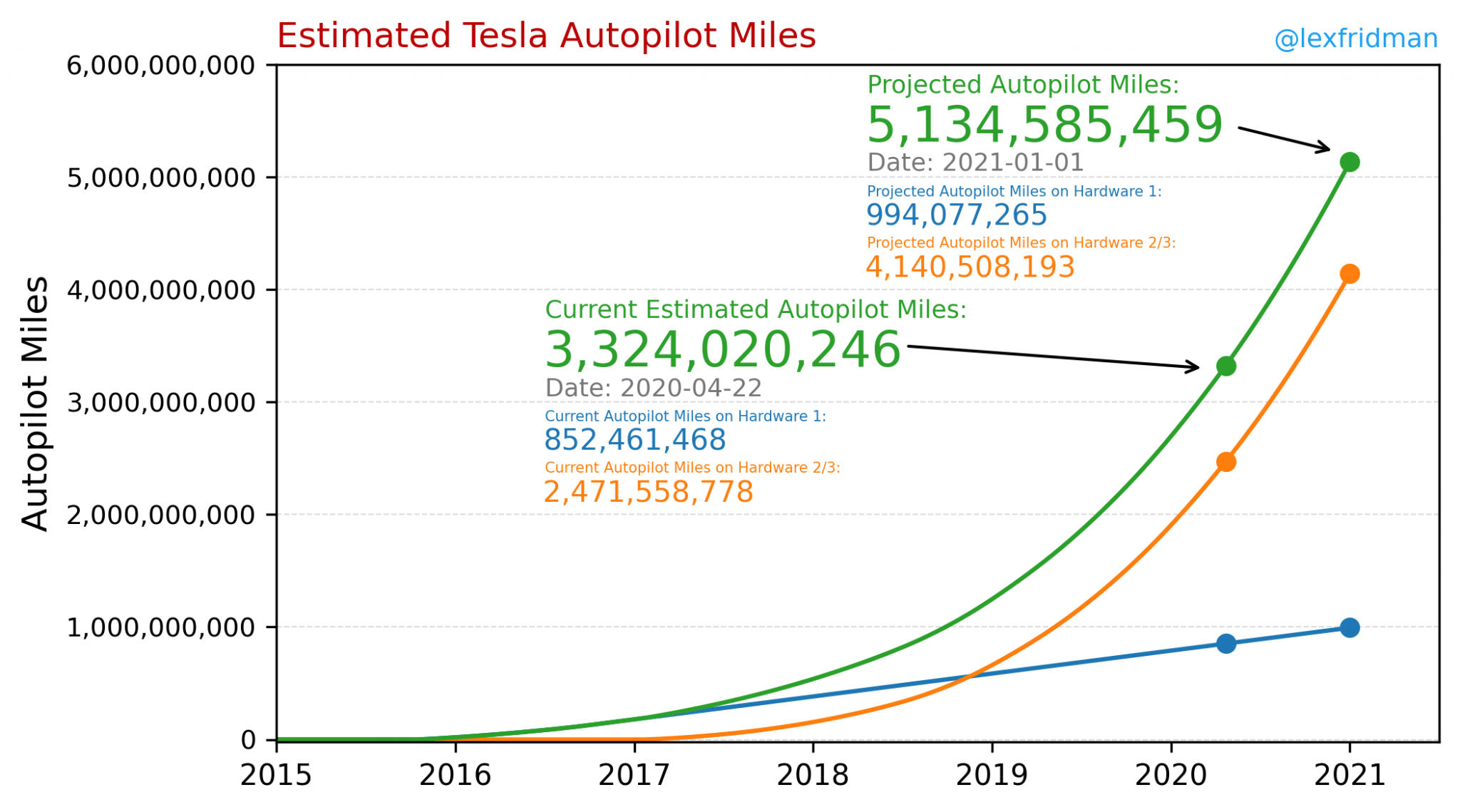

But if anyone is going to solve it, it is Tesla, as they have a humongous data lead by having over 1 million cars on the road that are collecting real-world data, every single day.

This data is then used to train a deep neural network, and each data points improves its performance and reliability.

There is no company in the world that comes even close to having this amount of real-world data, and so many are using computer simulations to train their AI, which is just not going to cut it.

Besides, all competitors are using LIDAR technology, which is bulky, and cannot distinguish a rock from cotton candy.

Tesla chose the route of computer vision, which is much harder to perfect, but ultimately superior for this particular application.

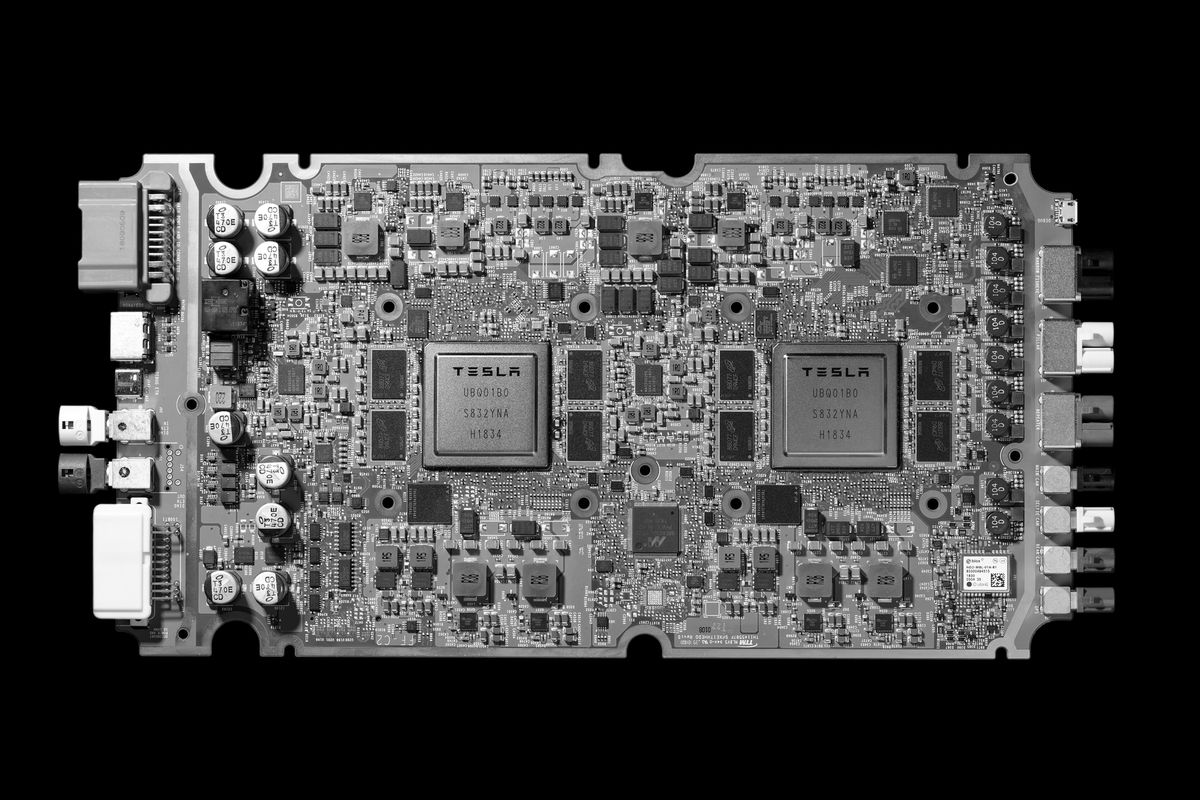

All of this is made possible thanks to Tesla's in-house developed Full Self-Driving Computer, also called Hardware 3.

An engineer from a Japanese car company said "we cannot do this", and car manufacturing experts said this chip is about 6 years ahead of GM and the like.

Tesla saw the need to develop this chip themselves, as off-the-shelf products like Nvidia's AI chips used way too much power, and were not optimized for computer vision tasks.

So Tesla today has the most powerful self-driving chip in the world, as well as a gigantic data lead, making it very likely that they will be the first company to solve level 5 autonomy.

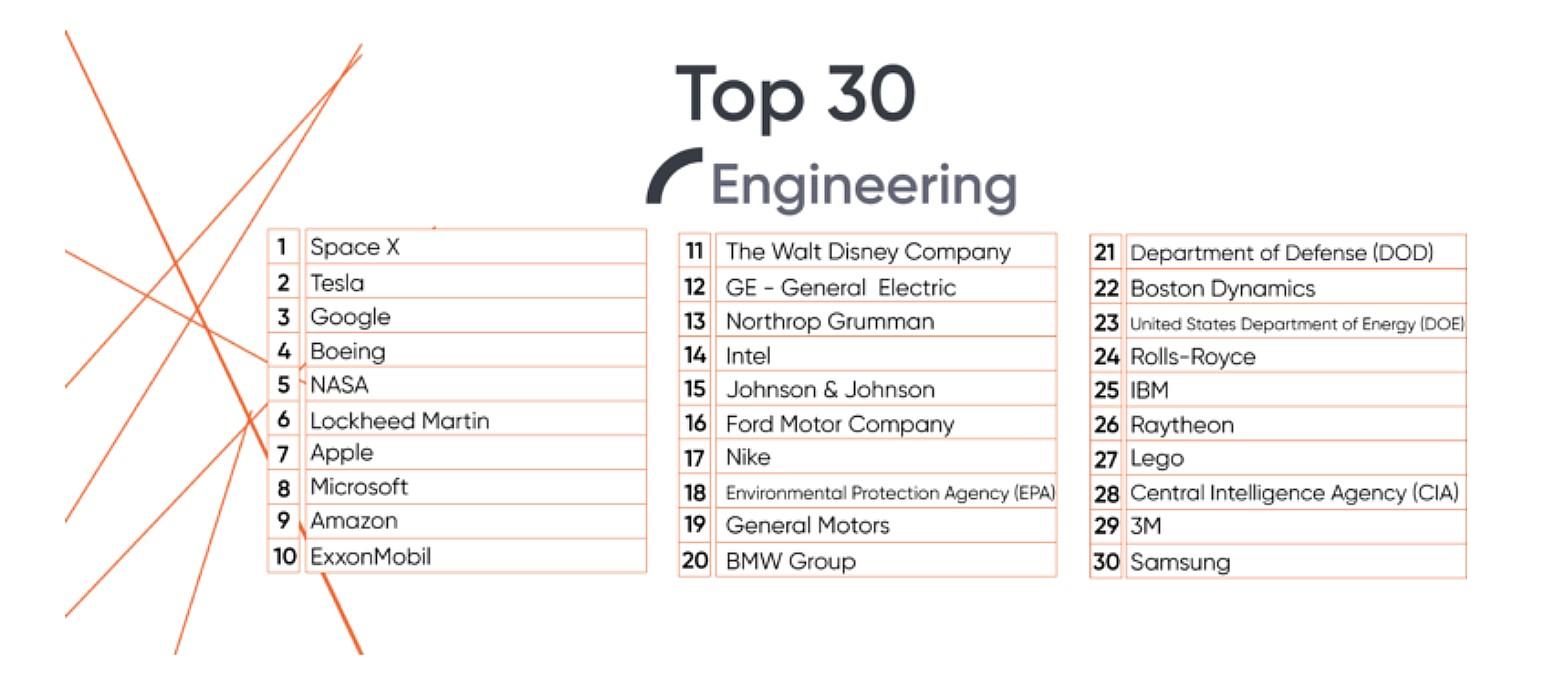

Talent

So why is Tesla able to innovate so rapidly?

One word: talent.

Tesla is the #2 most popular company to work for, as voted by engineers (#1 being Musk's other company, SpaceX, who regularly move engineers between them when needed).

So Tesla has its pick of the very best engineering talent in the world.

This matters!

Alan Eustace from Google said:

One top-notch engineer is worth "300 times or more than the average," explains Alan Eustace, a Google vice president of engineering. He says he would rather lose an entire incoming class of engineering graduates than one exceptional technologist. Many Google services, such as Gmail and Google News, were started by a single person, he says.

Financials

Finally, let's look at Tesla's current financial position, as all the things mentioned above will be useless if the company goes bankrupt before it is able to implement all of its bold plans.

In Q1 2020, Tesla had a cosy $8 billion in cash (enough to build 4 Gigafactories), although there is also a significant amount of debt on their balance sheet.

They also generated about $1 billion in free cash flow over the last 12 months, even after paying for operating expenses and new Gigafactories, which means money is coming in faster than they can spend it.

It is 100% true that Tesla's financials are not what I normally look for as a value investor.

They have a negative return on equity, while I normally look for > 15%

They have a 1.27 debt-to-equity ratio, while I normally look for < 0.5

They have a 1.24 current ratio, while I normally look for > 2

Yet it is clear that they are on a path of exponential growth.

I consider this a special situation that is too good to pass up, and so I made an exception for Tesla.

Tesla in 2030

Now that we established where Tesla is today, let us pull out our crystal ball and make some educated guesses about the future.

If we assume that Musk's second Master Plan will become a reality, we should see:

- Bigger energy business

- A vehicle for every market segment

- Full self-driving

- Customers earning money with their Tesla products

To accommodate these dreams, many more Gigafactories are needed.

Luckily, costs per factory are declining rapidly, and construction + ramping only takes about a year now, so in 10 years we can reasonably expect a minimum of 10 extra Gigafactories.

Likely even more than that, as Musk plans to 50X the current output from its Gigafactories.

Future profit margins on car sales should continue to increase significantly as production processes are further optimized.

Even software-like margins seem possible once full self-driving is released, from robotaxi fees, Autobidder fees, as well as an in-car app store for entertainment purposes, since the driver no longer has to pay attention to the road and has this big, beautiful screen in front of him.

While VW is finally taking electric vehicles seriously, many other car makers are still sleeping, and even VW is too late to the party to catch up with Tesla.

Yes, they have more money and more people to throw at the problem, but in technology the following saying holds true:

"Even if you get 9 women pregnant, you won't be able to make a baby in 1 month."

Tesla has a head start of a few years, and this cannot simply be undone by throwing money at it.

Sooo, it seems likely that once the sleeping giants realize they are too late to the party and are not able to catch up in time, they will seek to license Tesla's battery, drivetrain, and self-driving technology.

And licensing fees are ultra-high margin.

Tesla has only just started building out its own battery production line and R&D lab, and yet they've already developed a battery that will only degrade 10% in 1 million miles, after which it can still be used in grid storage solutions, until it is finally recycled.

It further seems possible that Tesla's energy business will have reached a size comparable to that of their car division by 2030, as Musk expects.

Now for the trillion dollar question:

How much will Tesla stock be worth in 10 years?

Normally, when we value investors try to determine the value of a company, we use something like a Discounted Cash Flow model.

However, this only really gives a reasonably accurate result if a company has stable, predictable earnings.

This is not the case with Tesla.

This is also why Aswath Damodaran's valuation of $650 per share based on today's numbers seems reasonable, but using his approach to extrapolate to 2030 would severely underestimate Tesla's potential.

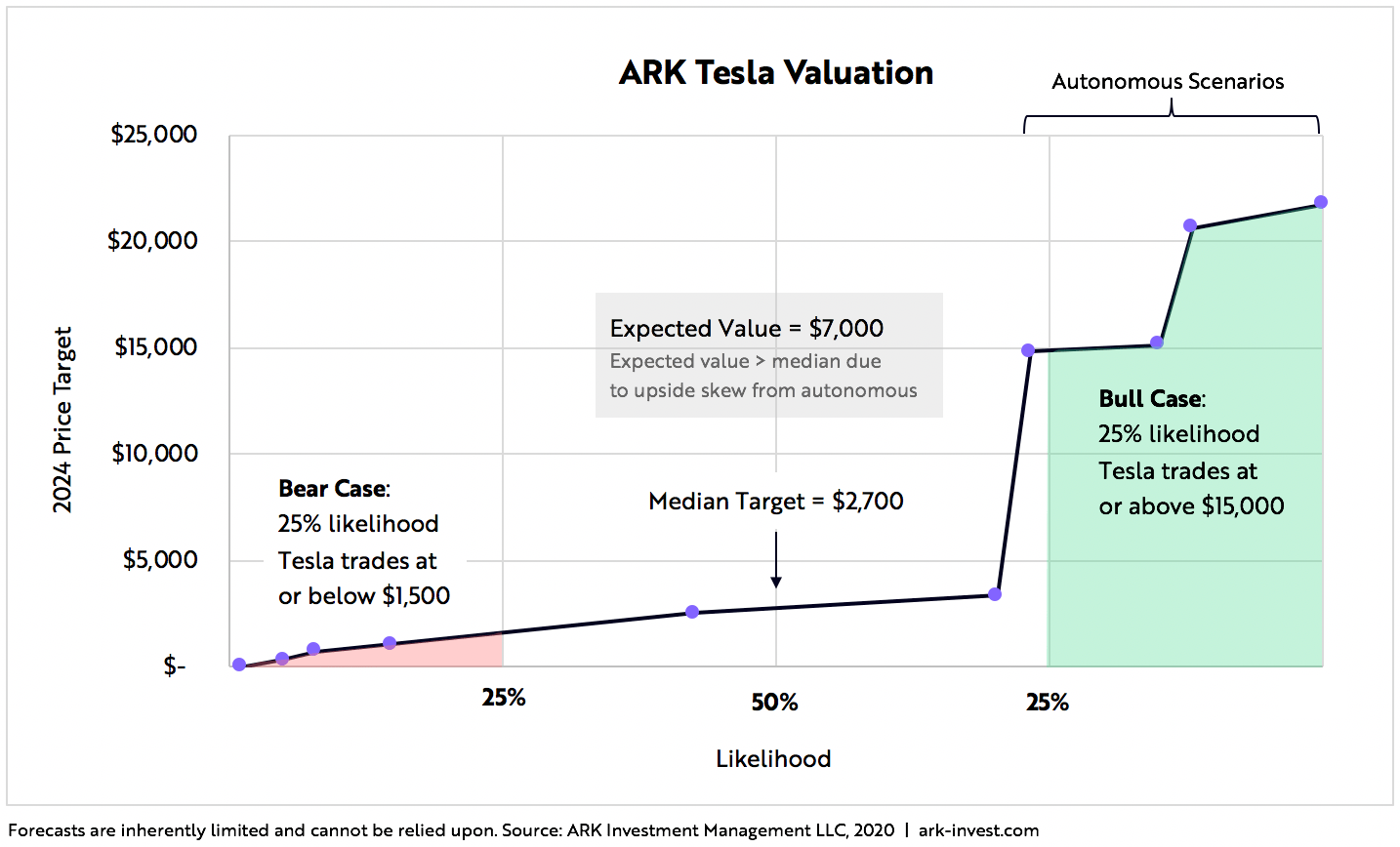

The investor from my investment club, who has a 5000% return since 2009, sees a potential $500 billion market cap for Tesla in 2024, or $2700 per share.

Billionaire investor Ron Baron believes Tesla could be worth $1.5 trillion by 2030.

We’re going to make 10 times our money from here... Tesla could be worth $1.5 trillion, ultimately putting it among the largest and most valuable companies in the world.

ARK Invest, who have several people from different specialties working on this one evaluation, expect Tesla stock will be worth $7000 by 2024 already.

That implies a market cap of $1.3 TRILLION by 2024, 6 years before we reach 2030!

Self-made millionaire Steven Mark Ryan, from the Solving the Money Problem YouTube channel I mentioned earlier, has been researching Tesla in-depth since 2016, and with some back-of-the-napkin math, he roughly estimates a $5 trillion market cap by 2030 is possible.

So what do I think?

I think that, based on the thorough research from some very smart people, as well as my own research, a $2 trillion dollar market cap by 2030 seems plausible.

This means the stock could be worth ~$10.000 in 10 years time ($2000 after the recent 5:1 stock split).

I don't know of any other company with competitive advantages and technology leads similar to those of Tesla, and with so much room left to grow.

That is why my $450 average purchase price seemed very reasonable to me, even if only a fraction of that future valuation is ever reached.

Let's finish with a quote from Charlie Munger when asked about Musk:

I would never buy [Tesla], and I would never sell it short. And I have a third comment; Never underestimate the man who overestimates himself. I think Elon Musk is peculiar and he may overestimate himself, but he may not be wrong all the time.

Found this article insightful? Then click one of the share buttons now to help me spread this information.

NEXT: This Is How I Analyze Stocks In SECONDS

P.S. This is not investment advice, just my thoughts on TSLA stock. Want my thoughts on the metaverse? Then check out this article.